2018 Tax Bill and Real Estate Investment Planning

Content by Ephraim Schwartz & Teresa O'Dette. Consult your tax advisor to better understand how these changes to the 2018 tax code affect your personal situation.

Every tax return must either: Itemize deductions, or take a standard deduction. It must be one or the other and cannot be a combination. Mortgage interest deduction = Itemizing. Here's what every real estate owner should understand regarding whether to deduct their mortgage interest, OR take the standard deduction:

MORTGAGE INTEREST DEDUCTION

• Mortgage interest deduction is reduced from loan amounts up to $1,000,0000, to $750,000. This is for the primary residence + one vacation home, combined. $1.0M limit is grandfathered for:

- Mortgage debt incurred on, or before, Dec. 15, 2017.

- Mortgage debt incurred on, or before, Apr. 1, 2018, where the purchase contract was signed prior to Dec. 16, 2017 to close prior to Jan. 1, 2018.

- Rate & Term (non-cash out) Refinances of mortgage debt originally incurred prior to Dec. 15, 2017.

• Vacation Home mortgage interest can still be deducted if a primary residence mortgage is less than the $750k limit. If the two (primary & 2nd home) mortgages combined exceed the $750k, then only a portion of the vacation home interest would be deductible. Ex. Primary residence mortgage balance of $500k, and a vacation home mortgage balance of $500k, then all of the primary residence mortgage interest will be deductible, and half of the vacation home mortgage interest will be deductible.

• HELOC (Home Equity Line of Credit) debt interest can only be deducted if it was used for either; purchase, building, or improving the property.

• Cash-out (home equity) mortgage debt is no longer tax deductible. The previous limit was $100k.

STANDARD DEDUCTION

Standard deduction is increasing:

- Individuals: increase from $6,350 → $12k

- Married: increase from $12k → $24k

- Head of Household: is now $18k

The increase to the standard deduction combined with a decrease to mortgage interest deduction means the standard deduction will be the right decision for more people nationwide. This will impact the tax savings for some future purchases, but not all. It's true that first time home buyers of less expensive homes will be more likely to take the standard deduction, than make use of their mortgage interest deduction, going forward. However, in our high cost market, many individuals will still benefit from itemizing their mortgage interest deduction because their mortgage interest is still larger than the standard deduction. So, in addition to other reasons to invest in real estate, owning real estate will continue to be a tax advantage for most in this area.

REAL ESTATE INCOME DEDUCTION – NEW

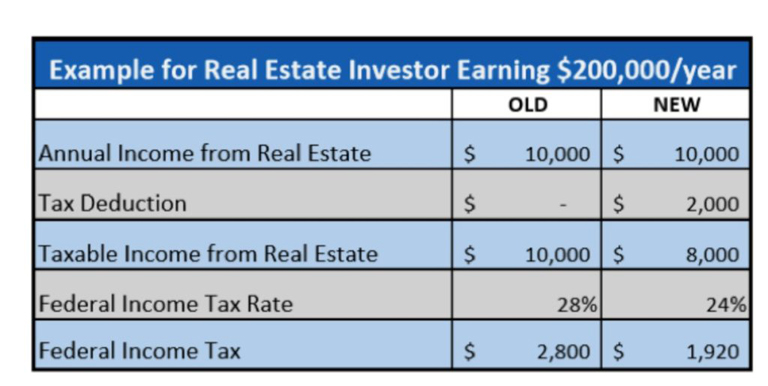

Income from real estate can be deducted by 20% under the new law.

This deduction will be a new benefit to some vacation & investment property owners in our market. The scenario that will benefit is when the loan amount on a primary residence alone maxes out the allowable mortgage interest deduction, as a 2nd home mortgage interest would not be deductible. Under the new law 20% of rental income is a new deducted on a vacation/investment property.

Example:

Notice both the tax bracket and taxable income change.

MARGINAL TAX BRACKETS

PROPERTY TAX DEDUCTION

Real estate taxes can now only be deducted up to $10,000. Previously, all property taxes could be deducted at no limit. Property taxes remain fully deductible for businesses or for-profit real estate reported on schedule E of tax returns.

Consider the combination of 20% deduction of rental income + the cap of state & local taxes: Less expensive homes & investment properties with good rental income may benefit, meanwhile more expensive homes not on schedule E are more likely to see an increased cost of homeownership.

GIFT TAXES

Annual:

- 2017 = $14,000/person/year

- 2018 = $15,000/person/year

Lifetime

- 2017 = $5,490,000/person

- 2018 = $11,200,000/person

*Portability between married couples, so actually ~$22.4M lifetime Gift Tax exemption between couples.

The majority of home buyers will not have to worry about their family paying gift taxes for any gifted down payment going forward.

CAPITAL GAINS EXCLUSION FOR PRIMARY RESIDENCE

Remains unchanged. If a property has been the primary residence for any 2 years within the most recent 5 yrs, then capital gains are excluded from tax up to:

- $250,000 for individual

- $500,000 for joint filers

HOME IMPROVEMENTS AS ACQUISITION INDEBTEDNESS

Substantial Improvement

- Adds to the value of the home

- Prolongs the home's useful life, or adapts the home to new uses

24 Month Look Back Period

12 Month Look Forward Period

Content by [email protected], [email protected]

Originally posted by Brit Crezee at Sierra Sotheby's International Realty